Insurance companies handle some of the most document-intensive processes in any industry. From underwriting and policy creation to claims processing and regulatory compliance, paperwork is at the heart of every customer interaction and operational task.

For teams juggling multiple formats, high volumes, and strict privacy requirements, managing PDFs efficiently isn’t just helpful—it’s essential. That’s where Nitro PDF comes in. Built for flexibility, security, and speed, Nitro helps insurance professionals streamline every part of the document lifecycle, from intake to archive, so they can focus more on service and less on shuffling files.

Process policy documents faster

Speed matters in insurance. Whether onboarding a new policyholder or modifying an existing agreement, agents and underwriters must turn around accurate, timely documentation. With Nitro PDF, teams can edit, annotate, and finalize policy files directly, without switching between multiple tools or systems.

Need to revise a coverage amount, add a new clause, or update customer details? Nitro’s intuitive editing tools make these changes quick and painless. You can modify text, insert images or logos, and adjust layout elements without needing to locate the original Word or design file.

These capabilities accelerate internal processing and reduce delays that often impact customer satisfaction or compliance SLAs.

Convert documents for easier sharing

Insurance teams work with a wide range of file formats: Word, Excel, scanned forms, images, emails, and more. Nitro PDF helps unify these assets into a standard, shareable format that keeps everything aligned.

Convert incoming documents (like ID cards, claims forms, or bank statements) into PDF to create a consistent case file. Or export outbound documents (such as summary of benefits or client agreements) into Word or Excel for easy edits and internal collaboration.

For teams that work with third-party partners—brokers, reinsurers, TPAs—this type of flexible conversion helps ensure compatibility, reduces back-and-forth, and minimizes costly formatting errors.

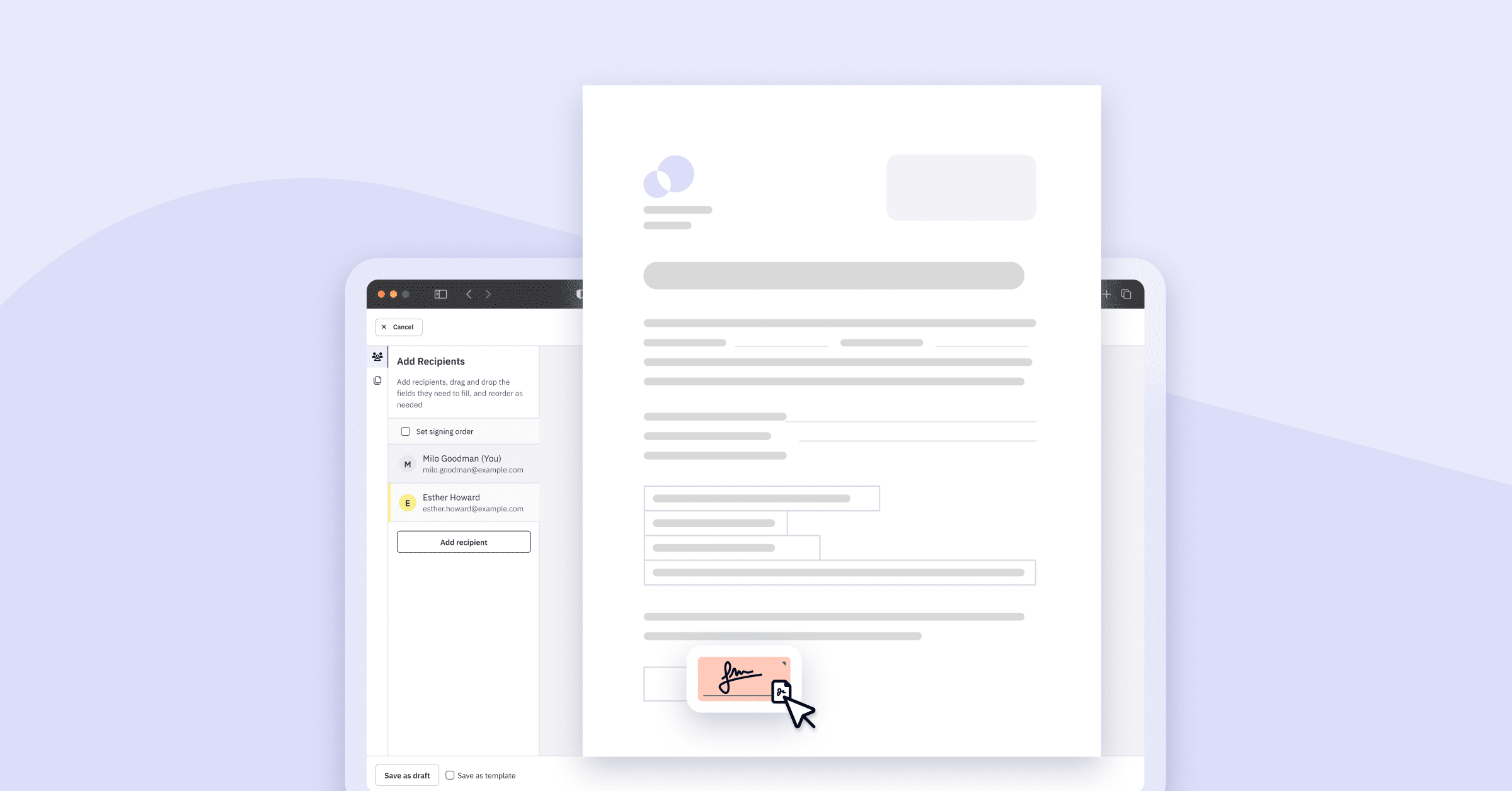

Digitize and automate form-based processes

Forms are the engine of the insurance industry. Claims, policy applications, change requests, renewals, and more depend on accurate, complete form submissions.

Nitro PDF allows insurers to digitize these forms with fillable fields, dropdowns, checkboxes, and signature areas, making it easier for customers and agents to complete and return them online. No printing, scanning, or email ping-pong required.

Nitro's AI-powered tools—Automatic Form Creation and Fillable Form Extract—are seamlessly integrated into Nitro PDF Pro for Windows and Nitro Workspace, allowing users to quickly generate interactive forms and extract data with minimal effort.

This digital-first experience not only improves customer satisfaction, it also speeds up processing times, reduces human error, and improves tracking across high-volume workflows.

For internal teams, Nitro also supports batch processing of forms, enabling claims departments and underwriting teams to generate, merge, and archive documents at scale.

Improve collaboration across departments

From sales and service teams to legal and compliance, insurance workflows often involve multiple reviewers and approvals. Nitro makes this collaboration simple and traceable, with built-in tools for commenting, redlining, and version control.

Underwriters can review annotated policies from sales reps. Claims adjusters can add notes to documentation shared by field agents. Legal teams can flag language changes or policy gaps, all without creating multiple copies or relying on external messaging platforms.

This streamlined collaboration is particularly valuable in distributed or hybrid work environments, where secure, centralized document access is key to keeping teams aligned.

Protect sensitive customer information

Trust is everything in insurance. Customers entrust providers with personal, financial, and medical information, making security a non-negotiable part of document management.

Nitro PDF offers enterprise-grade security features to help insurers meet strict regulatory obligations, including HIPAA, GDPR, and SOC 2. Password protection, permissions management, and full redaction tools are built in, allowing teams to securely store and share sensitive documents without risk of exposure.

Whether removing personal data before sharing claim files externally or locking down templates to prevent unauthorized edits, Nitro puts control in the hands of the user, helping your business stay compliant and your reputation intact.

Built to scale with insurance operations

Whether you’re a local agency or a national carrier, Nitro PDF provides the flexibility to grow with your operations. Different teams have different needs, from individual agents filling out forms in the field, to back-office teams processing hundreds of claims per day.

Nitro’s PDF solution includes multiple plans—Standard, Plus, and Pro—designed to meet the needs of both individual contributors and enterprise departments. And because it integrates with your existing systems, Nitro complements rather than complicates your current workflow.

Work smarter in a document-driven industry

Insurance may be built on documents, but your team shouldn’t be buried in them. With Nitro PDF, insurance professionals can spend less time managing files and more time supporting customers, reducing risk, and delivering service with speed and confidence.

Start your free 14-day trial of Nitro PDF today and see how smarter document workflows can benefit every line of business, from claims and compliance to sales and service.

/Card-Page%20Previews-AI.png?width=1200&height=800&name=Card-Page%20Previews-AI.png)